Import Control System 2 (ICS2)

Economic operators carrying goods by sea, inland waterways, road and rail will have to submit a complete Entry Summary Declaration (ENS) dataset to ICS2 by end of 2024.

We would therefore like to provide an update on how the new European import control system regulations (ICS2) will impact your booking procedures and/or cargo planning. Please see our Q&As below for detailed information.

The European Union is implementing a new customs pre-arrival security and safety programme, effective as from December 4, 2024. To comply with the new regulations, we will need to supply additional booking information. You will ultimately be responsible to providing accurate data.

New mandatory information includes commodity codes, the EORI number and buyer & seller information. Without this information, we are unable to ship your cargo.

What is the Import Control System 2 (ICS2)?

ICS2 is an enhanced customs system which will collect data on all goods entering the single market of the European Union (EU) before they arrive. By analyzing this information, customs authorities can protect against security risks and streamline customs processes for legitimate trade, making it easier for businesses to move goods within the EU.

What is an ENS?

An ENS is an Entry Summary Declaration for consignments arriving into the European Union’s customs territory. Prior to moving goods into the EU an Entry Summary declaration must be submitted by the relevant transport operator.

What is the scope of ICS2?

This new phase will cover the transportation of goods by maritime and inland waterways to or through the EU, Northern Ireland, Norway or Switzerland. Maritime and inland waterway carriers will need to submit a complete Entry Summary Declaration (ENS) in the ICS2 system for all goods before their arrival into the EU. For deep sea, the ENS needs to be submitted 24 hours prior departure from load port.

We would like to emphasize that ICS2 is not a pure import regulation but also covering EU origin cargo which is on board the vessel during a port call outside the EU.

When will these new regulations take effect?

The implementation of the ICS2 is due by December 4, 2024.

We will then start lodging Entry Summary Declarations (ENS) into ICS2. This applies for all WEC Lines cargo on vessels arriving at their first non-EU load port of a voyage December 1st, 2024, or thereafter.

Considering the first bookings for above-mentioned voyages are coming in already, we kindly ask you to provide additional/changed data elements in your shipping instructions with immediate effect.

Who is responsible for the ENS declarations?

Ultimately the vessel operator bringing the goods into the EU is responsible for lodging an ENS. However, in cases of vessel-sharing agreements or other long-term contracts, the carrier issuing the Bill of Lading is tasked with timely electronic ENS transmissions.

In case of vessel sharing agreements or other long term contractual agreements, the Bill of Lading issuing carrier is responsible for the timely electronic transmission of the ENS. If the carrier does not have all the legally required information for a complete ENS submission and the client does not wish to provide this to WEC Lines, then the client can choose multi-filing options.

What ENS filing types are available?

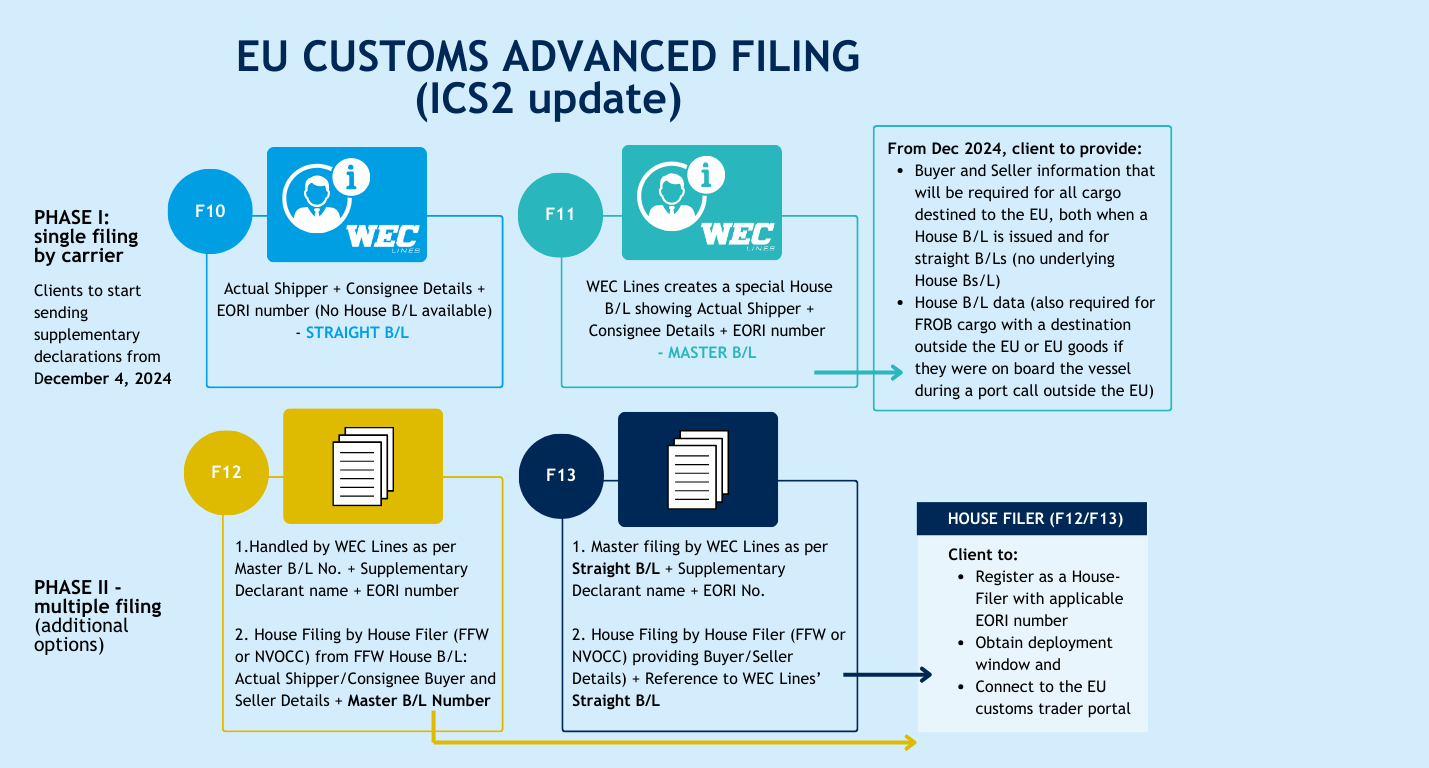

If WEC Lines handles full ENS filing, you have two options:

- F10 – Straight B/L + Buyer & Seller data

- F11 – Master B/L, House B/L + Buyer & Seller data

If Client does not wish to provide the House level information to WEC Lines , the client can choose the Multi-filing option by providing the Name & EORI Number of the Supplementary Declarant. A in Europe for ENS filing registered Supplementary Declarant with its EORI Number is mandatory.

- F12 – Master B/L (multi-filing: Master B/L – Master level filing by WEC Lines, Supplementary Declarant and EORI number required.

House level filing by House Filer’s, House B/L Number under Supplementary Declarant’s EORI Number – Master B/L Number required. - F13 – Straight B/L (multi-filing: Straight B/L No – Master level ENS filing by WEC Lines, (ENS submission by House Filer – Supplementary Declarant EORI Number. No House B/L, but WEC Lines’ Straight B/L Number and Buyer/Seller details.

If you do not intend to share buyer/seller or House BL data with us, please register as a House Filer with your applicable EORI number, obtain a deployment window and connect to the EU customs trader portal. For more information, click here.

House Filers can start sending their supplementary declarations from the 4th of December.

What information do I need to provide with my booking?

You must provide the following information with each booking:

- Commodity code (six-digit HS code) for each cargo item plus complete and accurate cargo description. Find our more here.

- The Economic Operators Registration and Identification (EORI) number of the consignee established in the EU (if such a number was assigned to this party) or the full address of the consignee, including the P.O. box number, postal code, sub-division code, city, and country. Find out more about the EORI number here.

- EORI of the supplementary declarant (self-filer) of House B/L and/or Buyer/Seller data

- Buyer and Seller data is required for all cargo destined to the EU, both when a house B/L is issued as well as for straight B/Ls (no underlying House Bs/L)

- UCR number (if available)

- CUS code for harmless and DG chemicals (if included in ECICS/ European Customs Inventory of Chemical Substances: click here)

- House level data (also required for FROB cargo with a destination outside the EU or EU goods if they were on board the vessel during a port call outside the EU)

Do I need to provide the required data for each booking or can WEC Lines do this for me?

The ICS2 regulation requires the implementation of house-level data filing for House Bills of Lading (so-called multi-filing) and the EU Customs request on information about the Actual Buyer and Seller of the cargo. We can log your data on your behalf provided that all relevant data elements are shared with us in advance.

For freight forwarders who intend to arrange their own house level filing in the future, please keep in mind that the deployment window will start on December 4, 2024, and will end on April 1, 2025.

What do I need to provide if I want WEC Lines to file on my behalf?

In case you would like WEC Lines to file on your behalf, from December 4 onwards, you must provide:

- Buyer and Seller information for all cargo destined to the EU, both when a House B/L is issued and for straight B/Ls (no underlying House Bs/L)

- House B/L data (also required for FROB cargo with a destination outside the EU or EU goods if they were on board the vessel during a port call outside the EU)

What is the cut-off time to provide the information for a booking?

It is important that we receive complete and accurate shipping instructions latest at the time of documentation cut-off stipulated in the booking confirmation.

If the shipping instructions are not received on time, we will be unable to carry out the advanced filing of customs declarations as mentioned in the regulation and regretfully strictly follow “No MRN / no load”.

This means that we will not be able to load your cargo without having received a valid MRN (Movement Reference Number) from EU Customs.

What is WEC Lines doing to prepare for correct ENS filing?

You will find an EU customs indicator whenever your cargo is relevant for ENS filing in the WEC Lines booking confirmation.

Meanwhile, we are updating our web-based operational system Odyssey to include these specific features, and we are in dialogue with the shipping portals to accommodate the required data elements in the specifications for the EDI shipping instruction.

Finally, we will be contacting Direct EDI customers to discuss the options to update the EDI interface and ensure ICS2 readiness in the coming weeks.

What if I don't want to share the Actual Buyer and Seller details?

Under the new ICS2 regulations, for goods with the final destination in the European Union, it is mandatory to provide the actual buyer and seller details of the goods (these may be different from the shipper / consignee). If the final place of delivery is non-EU, then the actual buyer and seller details are not required.

The buyer and seller information must be provided if you require us to make the “full ENS filing” (EU Filing type F10 / F11). However, under the new ICS2 setup there is the option for “multiple filing”. In this scenario (filing type F12/F13) it is not necessary to provide us with the actual buyer and seller information, but it is mandatory to provide the supplementary declarants’ EORI number.

We will continue providing updates related to the EU Customs Advanced Filing. For any questions or concerns, please contact us via ICS2@weclines.com.